Mohamed Elshnwany

Connect with Mohamed Elshnwany to Send Message

Connect

Connect with Mohamed Elshnwany to Send Message

ConnectTimeline

About me

Experienced Products Portfolio Manager | Expert in Retail & Corporate Credit Risk, Fintech Integration, Islamic Banking & Sharia Compliance | Driving Digital Transformation & Strategic Business Development

Education

Egyptian Banking Institute

-Diploma Retail Credit Management

Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)

2011 - 2012Certified Sharia Adviser and Auditor (C.S.A.A) Islamic Banking AAccounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)location : Manama , Bahrain

General Council for Islamic Banks and Financial Institutions

2010 - 2010Certified Islamic Banker (C.I.B) Islamic Banking AGeneral Council for Islamic Banks and Financial InstitutionsLocation : Manama , Bahrain

CIW

2000 - 2001Certified Internet Web Master (CIW Professional ) Electronic Commerce AE-Commerce Web Applications developer & Designer

Zagazig University

1996 - 2000Bachelor's degree Accounting Good (67/100)

Project Management Institute

-Diploma Project Management Professional (PMP)

Paris ESLSCA Business School

2012 - 2015Master of Business Administration - MBA Banking & Risk Management A (3.75/4.00)Founded in 1949, ESLSCA (Ecole Supérieure Libre des Sciences Commerciales Appliquées) is a private and independent institution of higher education. ESLSCA is a Grande Ecole de Commerce (exclusive graduate business schools that admit students through extensive entry exams) and is fully accredited by the French Ministry of Education

Experience

.webp)

National Bank of Egypt (NBE)

Apr 2004 - now* Key Responsibilities & Achievements:• Oversee daily banking operations, ensuring smooth cash flow management and efficient transaction processing across all functional areas, including front office and teller operations.• Lead a high-performing operations team, drive talent development, and strengthen internal audit practices to maintain operational excellence.• Supervise trade finance operations, ensuring full compliance with regulatory frameworks, internal policies, and risk management protocols.• Manage banking compliance activities, ensuring accuracy, operational integrity, and adherence to regulatory standards.• Design and implement strategic business plans to optimize efficiency, mitigate risks, and support sustainable growth.• Develop and execute financial contingency plans to protect business continuity during crises or economic downturns. Show less * Key Responsibilities & Achievements:• Led end-to-end trade finance transactions, including Documentary Letters of Credit (LCs), Standby LCs, and Guarantees, ensuring timely issuance, amendments, and settlements in compliance with regulations and policies.• Managed customer trade finance needs with a strategic, relationship-focused approach, delivering customized financial solutions while ensuring seamless coordination with other banking divisions.• Monitored trade transactions for compliance with anti-money laundering (AML) regulations, risk mitigation strategies, and internal policies, ensuring operational integrity.• Supervised the positioning of trade-related funds, working closely with the Treasury Unit to optimize liquidity management and cash flow efficiency.• Reviewed and validated insurance documents, ensuring accuracy, risk mitigation, and compliance with underwriting standards.• Represented Trade Services in high-level meetings and forums, fostering synergies between Retail and Commercial Banking to improve customer experience and operational efficiency. Show less * Key Responsibilities & Achievements:• Reviewed and assessed retail credit risk management frameworks, ensuring compliance with regulatory standards and reinforcing operational resilience.• Assisted in the development of the Branch Risk Review Plan, implementing effective risk assessment methodologies and monitoring techniques to enhance credit risk management.• Designed and enforced risk management procedures for new credit and charge account applications, ensuring strict compliance with policies and regulations.• Led periodic evaluations of asset quality and credit risk exposure, providing senior management with detailed reports to guide decision-making and proactive risk mitigation.• Organized risk awareness programs and trained branch staff, fostering a strong risk management culture within retail banking operations.• Monitored bad debt provisions and negotiated repayment strategies for delinquent accounts, ensuring compliance with central bank regulations and maintaining financial stability.• Refined credit risk management practices to align with the bank’s strategic goals, regulatory requirements, and industry trends.• Developed robust risk assessment methodologies and compliance procedures to mitigate risks in credit approvals and account management.• Led delinquency monitoring efforts, negotiating repayment plans and overseeing recovery processes to manage loss given default (LGD) and bad debt provisions.• Collaborated with business line managers and compliance teams, overseeing credit risk staff and delivering training to enhance policy adherence and regulatory compliance.• Ensured compliance with central bank regulations by Analyzing daily MIS reports and managed bad debt provisioning, implementing proactive measures to ensure portfolio quality and minimize risk exposure. Show less • Monitoring and evaluating the retail credit risk management practices and allied business trends and developments.• Continuously reviewing and improving the retail credit risk management strategy in line with the bank’s overall strategy, risk appetite and its regulatory requirements.• Evaluating retail credit risk management policies and standards and key retail credit Risk parameters in coordination with retail credit function.• Implementing internal controls, policies, and procedures pertaining to risk involved in new credit and charge accounts applications accordingly.• Developing and fostering relationships with appropriate retail marketing managers for new products campaigns.• Preparing, documenting and presenting periodic assessments of asset quality, credit risk management and the adequacy of all and related processes.• Prepared weekly and monthly reports of all credit accounts and provided reviews to the upper management to assess variances and take necessary action for all emergency accounts.• Coordinating and supervising all subordinates, imparting training on policies and updating on policy changes to ensure bottom up adherence. • Identify accounts requiring collection agency or legal action and coordinate collections with third party contractors• Maintain bad debt and bad debt recovery records.• Develop processes and procedures for evaluating customer financials and setting credit lines/limits.• Negotiate payment programs with delinquent customers which subject to default.• Performs phone collection activities for multiple products, participates in the early, mid or late stages of the collection process to include loss mitigation, pre charge-off, charge-off, recovery, bankruptcy.•Review the monthly bad debts provisions, according to central bank regulations. Show less * Key Responsibilities & Achievements:• Fostered strong client relationships, driving engagement, retention, and business growth by offering tailored solutions to address challenges and enhance long-term partnerships.• Cultivated relationships with key contacts at potential client companies, expanding business opportunities through proactive sales efforts and strategic growth initiatives.• Led one-on-one client meetings, presenting services, guiding decision-making, and identifying opportunities for cross-selling and upselling to meet client-specific needs.• Monitored industry trends and competitor activities to refine strategies, anticipate market shifts, and enhance client satisfaction and retention.• Established and met revenue targets by aligning business goals with market opportunities, driving financial growth.• Delivered exceptional customer service, swiftly addressing complaints and resolving issues with professionalism to maintain trust and loyalty. Show less * Key Responsibilities & Achievements:• Evaluated financial records for accuracy, compliance with internal policies, and alignment with accounting standards, ensuring operational transparency.• Verified the correct documentation and processing of financial commitments, invoices, and payments to maintain accurate financial reporting.• Contributed to risk-based audit planning, optimizing coverage of key risk areas and strengthening financial and administrative controls.• Conducted internal audits to assess operational effectiveness, identify inefficiencies, and enhance internal controls to mitigate risks.• Ensured compliance with local and international regulations, accounting policies, and contractual obligations through comprehensive financial reviews and compliance checks.• Identified financial and operational risks, recommended mitigation strategies, and guided improvements to internal controls, reducing fraud and errors. Show less * Key Responsibilities & Achievements:• Developed new business opportunities within the SME sector across the bank’s network, meeting established business limits and objectives.• Collaborated with relationship managers and branch managers to monitor and grow the bank’s SME portfolio, achieving business targets.• Cross-sold the bank’s products and services, ensuring comprehensive usage and maximizing client engagement.• Supported the implementation of the SME program, providing essential business support to drive success.• Enhanced SME product knowledge within the branch network through targeted team training and development initiatives.• Prepared and implemented growth strategies and expansion plans, providing senior management with reports on business progress and outcomes.• Fostered excellent customer relationships, driving both new customer acquisitions and high retention rates.• Monitored market trends and competitor activities to identify opportunities for customer acquisition and expand market share. Show less

Banking Opertaions Manager

Aug 2019 - nowForeign Trade Finance Unit Manager

Nov 2017 - Jul 2019Retail Credit Risk Deputy Manager

Jan 2011 - Oct 2017Retail Credit Risk Supervisior

Jan 2011 - Jul 2016Relationship Manager - Customers Service Division

May 2009 - Dec 2010Internal Auditor

Jul 2005 - May 2009SMEs Specialist - Credit Division

Apr 2004 - Jun 2005

Licenses & Certifications

Certified Management Accountant (CMA) - In progress

CMA, IPA.webp)

Operational Risk Management - 8 hours

National Bank of Egypt (NBE)Oct 2015.webp)

Certified Management Accountant (CMA)

Institute of Management Accountants (IMA)Jan 2017

Web Application Development (E-Commerce Track) - 900 hours

IBM EgyptApr 2001

FINTECH & Financial Inclusion Professional Certificate - 30 hours

WellGrow TrainingDec 2022

Languages

- enEnglish

- arArabic

- geGerman

- frFrench

Recommendations

Sandeep sharma

Senior Executive Paramedic Nurse Indigo airlines flight ✈️ SafteyKanpur, Uttar Pradesh, India

Neha thukral

Assistant ManagerKuala Lumpur, Wilayah Persekutuan Kuala Lumpur, Malaysia

Miyako kuroiwa

Multi-Channel Marketing Specialist | Paid Search & Social | Seeking Full-Time OpportunitiesLondon Area, United Kingdom

Meet dave

Senior Process Executive at Infosys BpmJaipur, Rajasthan, India

Glenn hauwelaert

Student at UHasseltLeopoldsburg, Flemish Region, Belgium

Gabriëlle van geffen

Healthcare psychologistArnhem-Nijmegen Region

Khushboo chaubey

2k24 Graduate| Looking for Opportunities |MRU Bachelor of Business Administration Healthcare manage...Faridabad, Haryana, India

Ahmet yurdakul

Radyoloji Teknisyeni-TarihçiKonya, Türkiye

Kelsy marks

Site Supervisor at Mankato Area Public SchoolsMapleton, Minnesota, United States

Ali farhat

Senior Software Engineer at BrillioBucharest, Romania.webp)

Kamal jayasinghage cmt, bsc, fios, mih, phd(hon)

Founder at B&K Events & Catering LTD Volunteer LeaderTeddington, England, United Kingdom

Noël utter

Manager IT créatif : Analyse de besoins / Définition de solutions / Gestion de projetsRhinau, Grand Est, France

Amit kumar rastogi

Product Owner CSPO, SAFe5 POPM| MS Azure| ITIL at Lumen TechnologiesNoida, Uttar Pradesh, India

Nicky tiwari

Technical Service Engineer at Fujitsu | Ex-Wiproite | OpsRamp Implementation Specialist | OpenText M...Pune, Maharashtra, India

Puru pandey

Bachelor of Technology in Computer Science and Engineering (Artificial Intelligence & Machine Learni...Noida, Uttar Pradesh, India

Megan barber allende, cap®, mba

Executive Director and Chief Development Officer at the San Mateo County Community Colleges Foundati...Ukiah, California, United States

Germán schilman

Director General/Head Brewer en Cerveceria Corazón de MaltaAjijic, Jalisco, Mexico

Larry starnes

RetiredLive Oak, Florida, United States

Srishti priyadarshni

Communication Specialist @Autodesk | Corporate Communications, Public RelationsBengaluru, Karnataka, India

Saji antony

Compensation & BenefitsBengaluru, Karnataka, India

...

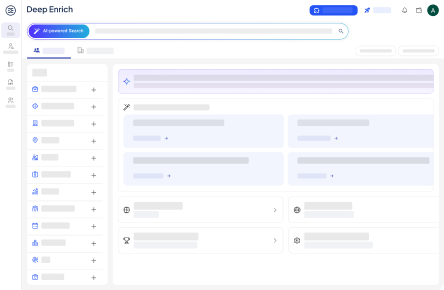

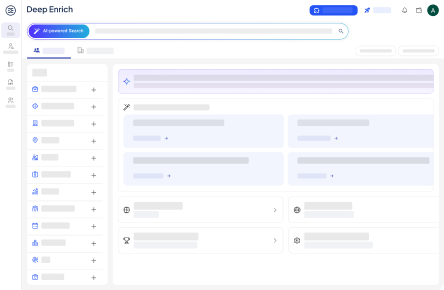

Deep Enrich

Deep Enrich