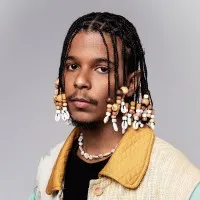

Amer Minkara

Customer Service Representative

Connect with Amer Minkara to Send Message

Connect

Connect with Amer Minkara to Send Message

ConnectTimeline

About me

Senior Relationship Manager at BankMed

Education

Saint Joseph University

-Bachelor Business Administration活動和社團:Football team member. I was elected as representative of the class for 3 consecutive years.

Université Sorbonne Paris Nord

-Masters Finance

Experience

Byblos Bank S.A.L

Jul 2006 - Jul 2006Customer Service Representative- Assist in all kinds of transactions (cash & cheque deposit, transfers...) - Sell banks’ products (loans, insurance, credit cards...)- Assist in opening accounts (current, saving)

AMCO (Accounting & Management Consulting)

Aug 2007 - Aug 2007Accountant- Prepare Balance Sheet and PL Statements for companies- Perform firms and pharmacies accounting- Assist the audit team in various projects

Bank of New York Mellon

May 2008 - Jul 2008Asset Management AnalystAsset Management Department :- Perform financial modeling and valuation through comparable company analysis (peer comparison), transaction analysis, and discounted cash flows analysis- Prepare exhaustive data analysis reports, equity templates and valuation presentations - Review & consolidate MIS reports related to Portfolio turnover, average annual return- Conduct several researches regarding several industries Vs Geographic focusing & Assets classes

.webp)

Libano-Française Bank S.A.L (Paris, France)

May 2009 - Aug 2009Assistant Relationship ManagerCorporate Banking Department :- Work on clients’ requests (Punctual line, Excess over the line, Transfers, Exchange and Swap operations...)- Discuss corporate requirements, lines structure (L/C, L/G, Overdraft....) with the related terms and conditions with the Relationship Manager- Commercialize & sell the bank products (loans, cards, insurances...)- Analyze the sectors in order to choose the right products and timing- Analyze corporate financial statements using Moodys’- Prepare credit file proposals for the credit committees with due focus on risk analysis and mitigate operational management and environmental factors and duly supported by the financial highlights, addressing key factors in accordance with Bank's policy. The credit presentations are prepared in concise and balanced manner, and reflect high quality and standards.- Contact clients to obtain some specific details about the activity and/or financial statements etc..- Collaborate with the other departments in the bank to solve some issues 收回

Banque Libano-Française

Jan 2010 - Aug 2014- Meet clients and find out their business needs and lend them the suitable credit facilities- Prepare a thorough credit proposals by covering market analysis and financial statements analysis by calculating various financial ratios (Solvency, Liquidity, and Profitability ratio...) taking into consideration the bank’s Standards Operation Procedures ‘SOP’ and Central Bank regulations- Coordinate and follow up regularly with the related departments.- Commercialize & sell the bank products (loans, cards, insurances...)- Analyze the market regularly in order to choose the right products- Follow up with clients to obtain the required documents in order to complete the credit file proposal- Maintain a good relationship with the existing clients and ensure that all their bank’s enquiries are met on timely and professional manner in order to maintain high customer service- Prepare short term business plan and client acquisition strategy in order to target new potential clients and offer them the best suitable banks products and services which fits their business requirements 收回 - Review and analyze credit proposals with the financial statements and cash flow projections for new and existing Corporate clients- Assessing non-financial information such as business risk, industry & market risk for corporate clients- Conduct sensitivity analysis and submit it to the Credit Committee.- Undertake spreading and in-depth meaningful analysis of corporate financial statements (Balance sheet, P&L, Income statement, statement of retained earnings, statement of cash flows)- Verify various ratios (Solvency ratio, Liquidity ratio, Profitability ratio ...) and comparative analysis through Moody’s software- Establish cordial relationship with all Business and Support divisions for effective coordination and provide clarification on any queries raised- Conduct detailed due diligence for the Credit Committee and higher approval levels covering all the aspects of risk related to the proposed and existing credit facilities for each customer.- Confirm customers’ credit risk rating and suggest changes where necessary based on customers solvency and operating performance/annual & interim financials and changes in market environment by focusing on the European, Lebanese and Syrian markets.- Validate procedures for Corporate and Risk departments for our subsidiaries in France, Switzerland, Cyprus and Syria 收回

Expert Relationship Manager

Jan 2011 - Aug 2014Corporate Credit Risk Analyst

Jan 2010 - Jan 2011

Societe Generale

Oct 2014 - Aug 2017Expert Relationship Manager- Develop the portfolio by searching for new clients and propose facilities for the potential ones- Conduct clients’ meetings to discuss their business needs and offer them the best suitable banks products andcross selling (funded and non-funded products)- Commercialize & sell the bank products (loans, cards, insurances...)- Create financial statements & cash-flows to get an unbiased view of company’s financial health- Maintain an excellent relationship with the existing clients and ensure that all their enquiries are met on timely and professional manner in order to maintain high customer service- Prepare business plan and client acquisition strategy in order to target new potential clients and offer them the best suitable banks products and services which fits their business requirements- Follow up with clients to obtain the required documents in order to complete the credit file proposal 收回

BankMed

Sept 2017 - Feb 2023Senior Relationship ManagerSmall and Medium Enterprises ‘SME’ Department - Build and develop a portfolio of corporate clients by granting them corporate facilities- Conduct site visits to clients and discuss their business needs and offer them the best suitable banks products and cross selling (funded and non-funded products)- Study financial statements and prepare cash-flows to evaluate company’s performance and thus choose the suitable facilities to grant- Assess regularly the market- Maintain and develop an excellent relations with existing clients and ensure that all their enquiries are met on timely and professional manner in order to maintain high customer service- Prepare business plan and client acquisition strategy- Follow up with clients to collect the required documents in order to complete the credit file proposal- Establish cordial relations with all Business and Support divisions for effective coordination and provide clarification on any raised queries- Conduct detailed due diligence for the Credit Committees and higher approval levels covering all risk aspects related to the proposed and existing credit facilities for each customer- Join Executive Credit Committees to present and discuss credit files and get the required approvals 收回

Licenses & Certifications

Chartered Financial Analyst "CFA" - Level 1

Institute For Financial Analysts (IFA)Dec 2014

Intermediate Credit

Six Sigma Training & Development Co LLCSept 2012

International Introduction to Securities & Investment

Chartered Institute for Securities and Investment (CISI),LondonSept 2012

Credit & Relationship Management

Six Sigma Training & Development Co LLCApr 2011

Letter of Credit and Letter of Guarantee

Banque Libano-Française S.A.LFeb 2011

Corporate Finance

Mr.Augustin Le Gouvello – Ecole Supérieure Des Affaires « ESA »Oct 2010

Proficiency in English

Georgetown University, Washington D.C, USAMar 2007

Languages

- enEnglish

- arArabic

- frFrench

Recommendations

Gheorghe camelia alexandra

Order Management Specialist at Hewlett Packard Enterprise with expertise in multilingual support.Bucharest, Bucharest, Romania

Cole morgan

FP&A Manager at Kalkomey Enterprises, LLCDallas, Texas, United States

Anna muriello

Operations Manager, Sacramento Region at BellaVista Landscape ServicesSacramento, California, United States

Uygar boztepe

Project Coordinator at ACPV ARCHITECTS Antonio Citterio Patricia VielMilan, Lombardy, Italy

Kalimar petitt

Sr. HR ManagerSeattle, Washington, United States

Otmane amel

Research/ML Engineer at UMONS | PhD studentMons, Walloon Region, Belgium

Monika sharma - csm,6σ black belt, llb, company secretary, bcom

Team Lead Manager at Brightleaf SolutionsPune, Maharashtra, India

Osama al-saadeh

5G RAN Product ManagementStockholm, Stockholm County, Sweden

Bashir abdullah tajuddeen

Fleet & Logistics Manager @ Babban Gona | Driving Efficiency, Managing AssetsNigeria

Lauran e.

Manager at Cafe Cru UKSwadlincote, England, United Kingdom

Umut yildiz

Investments Electrical Assistant Director at Memorial Healthcare Group, Electrical Engineer, Energy ...Istanbul, Türkiye

Katrina flowers

Manager, Human Capital Business SolutionsDallas-Fort Worth Metroplex

Jacqueline miranda

NoneChula Vista, California, United States

Gonçalo viana da silva

Advogado/Acessor Jurídico/FormadorAveiro, Aveiro, Portugal

Fathurohman fatoni

Banking Frontliner at PermataBankRangkasbitung, Banten, Indonesia

Zinhle sigola

Law Clerk to Justice Madlanga at the Constitutional Court of South Africa | LLB Graduate Cum Laude |...City of Johannesburg, Gauteng, South Africa

Lilandi niemand

Researcher | LecturerPretoria, Gauteng, South Africa

Sajjan sivia

Senior Software EngineerLondon, England, United Kingdom

Sai krishna, cfa

Sr. Associate - Investment BankingХайдарабад, Телингана, Индия

Del nunes

Publicidade | Direção de Arte | Criação PublicitáriaSão Paulo, São Paulo, Brazil

...

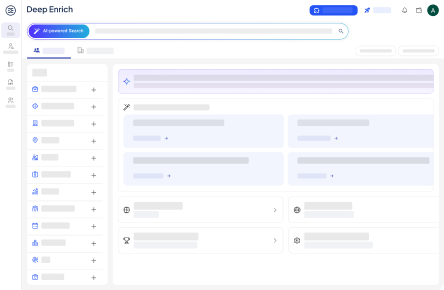

Deep Enrich

Deep Enrich