Alexander Goenaga

HEAD OF INSTITUTIONAL TRADING

Connect with Alexander Goenaga to Send Message

Connect

Connect with Alexander Goenaga to Send Message

ConnectTimeline

About me

Finance Director | Alternative Assets Portfolio Manager | FP&A | Financial Acumen | M&A | Risk Management | Private Equity Fund | Family Office |

Education

Pace University

2023 - 2023CENTER FOR GLOBAL BUSINESS PROGRAMS Business Administration and Management, General

EAE Business School

2022 - 2023Global Executive MBA Business Administration and Management, General

Universidad EAFIT

2004 - 2004Diplomatura Mercado de Capitales

Politécnico Grancolombiano

2003 - 2003Diplomatura Gestión de Riesgos Financieros y Crediticios

Columbia Business School

2019 - 2020International Certificate in Corporate Finance - ICCF Finance, General

Universidad EAFIT

2017 - 2018Especialización Estudios Politicos Economía Politica

Universidad EAFIT

2000 - 2006Administración de Negocios con Enfásis en Finanzas

Experience

BTG Pactual

Sept 2010 - Mar 2013HEAD OF INSTITUTIONAL TRADING- Collaborated in establishing BTG Pactual's office in Colombia, leading the expansion process and ensuring compliance with local financial regulations. This initiative solidified BTG’s presence in the Colombian market, creating new business opportunities and strengthening strategic relationships with key clients and institutions in the region.- Institutional Client Relationships and Development: Built and maintained strong relationships with institutional clients and global counterparts, serving as the primary contact to deliver tailored solutions aligned with clients’ investment needs. - Trading Strategy and Execution: Developed and implemented trading strategies in international markets to maximize institutional clients' investment returns, ensuring efficient order execution and competitive pricing. Show less

Grupo Bancolombia / Valores

Mar 2013 - Oct 2014HEAD OF INSTITUTIONAL INTERNATIONAL TRADING- Trading Strategy and Execution: Developed and implemented trading strategies in international markets to maximize institutional clients' investment returns, ensuring efficient order execution and competitive pricing. - Institutional Client Relationships and Development: Built and maintained strong relationships with institutional clients and global counterparts, serving as the primary contact to deliver tailored solutions aligned with clients’ investment needs. -Risk Management: Identified and managed risks in trading operations, especially in volatile markets, utilizing hedging and other strategies to safeguard client portfolios. Show less

Bebidas y Alimentos de Colombia SAS

Nov 2014 - Jan 2020Finance Director- Financial Leadership: : Led a team of 226 employees, designing and implementing strategies that drove value across multiple business lines, fully aligned with BACO's mission in sustainability and community development. Achieved a 20% cost optimization through process automation and enhanced supply chain efficiency, strengthening profitability in retail outlets and export operations. With a strategic focus on pricing and forecasting, maximized profit margins in a highly dynamic market. Additionally, solidified strategic relationships with key investors and partners, supporting BACO's expansion and ensuring alignment with ethical and sustainable standards at every stage of growth. - Risk Management and Strategic Planning: Collaborated closely with the board of directors to mitigate risks and capitalize on strategic opportunities, ensuring alignment with BACO’s vision of sustainability and community growth. Led proactive risk assessments to address commodity price volatility and international market fluctuations, protecting profit margins and securing financial stability. Improved financial indicators by an average of 1400 basis points above inflation, demonstrating effective risk management and strategic planning that optimized resources at each stage of expansion. Additionally, developed regulatory compliance policies and ESG (Environmental, Social, and Governance) practices, reinforcing BACO’s ethical and sustainable commitment across all operations. - Reporting and Forecasting: Led the reporting, planning, and forecasting of new business initiatives, with a strong emphasis on strategic scenario planning and analysis. - Investment and Asset Management: Managed liquidity investments and controlled fixed assets, optimizing returns and ensuring efficient asset utilization. -Stakeholder Engagement: Fostered connectivity and communication between financial and business stakeholders, enhancing collaboration and problem resolution. Show less

Agrow Hedge Fund/ Alternative investments: real estate, commodities, private equity.

Jan 2020 - Oct 2021Director of Finance & Investments - LATAM- Investment Fund and Portfolio Management: Administered and managed investment funds and portfolios in alternative investments valued at over USD 100 million, ensuring optimal asset allocation and performance. - Divestment Execution: Divested 25% of the portfolio to mitigate risks and realize gains and Designed securitization, private debt, and bank loan mechanisms. - Financial Analysis and Model Development: Led the design and implementation of advanced financial models to evaluate new investment opportunities across diverse asset classes, including REITs, commodities, secondary issuances, and high-growth startups. These models provided in-depth risk analysis, cash flow projections, and ROI assessments, supporting data-driven strategic decisions. Show less

Credicorp Capital / Private Equity Fund focused on alternative assets in Commodities & REITs.

Jan 2021 - Dec 2023Managing Director Alternative Asset - CCC- Leadership and Team Management: From a financial leadership perspective, I directed a workforce of 15 employees and managed over 80 indirect team members, coordinating a group of 5 executives across companies where the Private Equity Fund held economic interests. Focused on financial optimization, I ensured smooth operations, strict budget control, robust cash flow management, and strategic divestment initiatives to maximize portfolio returns. - Strategic Financial Planning and Analysis (FP&A): I developed and implemented comprehensive financial strategies that optimized processes and achieved a 32% cost reduction. Led the creation of detailed financial models for forecasting revenue and expenses, conducted variance analysis, and established key performance indicators (KPIs) to assess profitability. Additionally, I designed highprecision financial reports to support strategic decision-making, enhancing budget control and the efficient allocation of resources. - Sustainability and ESG Integration: Issued USD 5 million in carbon bonds on the European market to finance sustainable projects, contributing to environmental conservation and social responsibility. - Financial Impact: Achieved an average annual portfolio valuation increase of 15% through strategic debt restructuring, renegotiating terms with banks and suppliers to optimize financial conditions. Additionally, led the divestment of companies misaligned with the Private Equity Fund’s investment strategy, ensuring strategic coherence across the portfolio and enhancing overall returns for investors. - Stakeholder Engagement and Relationship Management: Fostered strong relationships with stakeholders, including investors, regulatory bodies, and community leaders. Show less

Barakus Capital HF

Feb 2024 - nowManaging Director- Development and Implementation of Investment Strategies in Venture Capital and Alternative Assets: I lead the identification and selection of high-growth, high-return investment opportunities in venture capital and alternative assets. I have designed a diversified strategy that enables Barakus Capital to optimize returns and maintain a competitive edge in the global alternative investment market.- Risk Management and Hedging Strategies: I oversee the implementation of advanced hedging strategies to mitigate volatility and protect portfolios against market risks. My approach focuses on safeguarding investors' interests through tools that maximize financial stability and preserve portfolio value during periods of high volatility.- Capital Structure Design and Financing Strategies for New Projects: I lead the creation of capital structures and financing strategies tailored to support high-impact projects in venture capital and alternative assets. This strategic management allows Barakus Capital to expand its investment opportunities and contribute to the growth of innovative companies that align financial and sustainable goals. Show less

Licenses & Certifications

- View certificate

.webp)

Alternative Investments for Financial Advisors

Corporate Finance Institute® (CFI)Oct 2023 - View certificate

.webp)

M&A Accounting and Purchase Price Allocation

Corporate Finance Institute® (CFI)Jul 2024 - View certificate

.webp)

Mergers & Acquisitions Financial Modeling

Corporate Finance Institute® (CFI)Aug 2024

Honors & Awards

- Awarded to Alexander GoenagaInversiones Alternativas para la construcción de la Paz , el desarrollo y la Inclusion Social FUNDACIÓN ONE SOCIAL Apr 2023 https://open.spotify.com/episode/6VFr69G6czZMf2mv3YY55f?si=0oVYMXkqT0-Y-y7pWaBrNQ&context=spotify%3Ashow%3A0KLymoQBbRFtv98djNsDWE

- Awarded to Alexander GoenagaFiltro Optimista - Inversiones Sostenibles (ESG) Fundacion Bancolombia Jun 2022 https://www.youtube.com/watch?v=7TpezoiTc8M

- Awarded to Alexander GoenagaProfesor de Catedra FP&A - Especializacion en Finanzas Universidad Católica Mar 2020 Dicte la catedra Universitaria ( Periodo 2020-2023) en la Formación integral en aspectos clave para la gestión financiera y el análisis financiero:-Contabilidad Financiera y de Gestión: Principios de contabilidad, preparación y análisis de estados financieros, normas contables internacionales (IFRS), costos de productos, presupuestos y toma de decisiones basada en costos.-Finanzas Corporativas: Valoración de empresas mediante métodos como el flujo de caja descontado y el valor presente… Show more Dicte la catedra Universitaria ( Periodo 2020-2023) en la Formación integral en aspectos clave para la gestión financiera y el análisis financiero:-Contabilidad Financiera y de Gestión: Principios de contabilidad, preparación y análisis de estados financieros, normas contables internacionales (IFRS), costos de productos, presupuestos y toma de decisiones basada en costos.-Finanzas Corporativas: Valoración de empresas mediante métodos como el flujo de caja descontado y el valor presente neto, decisiones de inversión y financiamiento, estructura de capital, costo de capital y gestión de riesgos financieros mediante derivados y análisis de sensibilidad.-Análisis de Desempeño y Control de Gestión: Los estudiantes aprenden sobre indicadores clave de desempeño (KPIs), desarrollo y seguimiento de KPIs, cuadros de mando integral (Balanced Scorecard), alineación de objetivos estratégicos con métricas de desempeño, benchmarking y sistemas de control de gestión.-Modelos y Métodos Cuantitativos: Estadística y econometría, análisis estadístico, regresión, pronósticos financieros, métodos cuantitativos para la toma de decisiones, programación lineal, simulación y análisis de decisiones bajo incertidumbre.-Mercados Financieros y de Capitales: Estructura y funcionamiento de los mercados de valores, análisis técnico y fundamental, teorías de portafolio, así como el estudio de instrumentos financieros como acciones, bonos, opciones, futuros y M&A.-Tecnologías y Herramientas de Información Financiera: Incluye sistemas de información gerencial (ERP, CRM, herramientas de Business Intelligence),técnicas de análisis de grandes volúmenes de datos y visualización de datos.- Estructura de Nuevos Negocios Financiero : Fintech, Banca Digital, P2P, Insurtech y IA Financiera.-Ética y Regulación Financiera: Se enfoca en la responsabilidad social corporativa, principios éticos en la toma de decisiones financieras, normativas regulatorias locales e internacionales, cumplimiento y auditoría. Show less

- Awarded to Alexander GoenagaPremio a la excelencia por administrar mas de 20,000 transacciones por año con un monto estimado de USD 1.2 billones. Grupo Bancolombia Mar 2014 Premio a la excelencia por administrar mas de 20,000 transacciones por año con un monto estimado de USD 1.2 billones.

Languages

- enEnglish

- spSpanish

Recommendations

Mahmoud fawzy

Senior Frontend Developer at FlairsTechCairo, Egypt

"salvatore ""skip"" dito"

IT Support Specialist at Cresco LabsSan Francisco Bay Area

Laila shareena burgos

Looking for new opportunities | Content Executive – Social Media CoordinatorMetro Manila, National Capital Region, Philippines

Alexander vatmanides

MEng AMIMechE || Mechanical Engineer || Design EngineerWestbury, England, United Kingdom

Boguslaw skowron

Social Media Marketing I Digital Marketing I Facebook Content Manager I Facebook Ads SpecialistWarsaw, Mazowieckie, Poland

Vaishnavi gothe

Python | Java | C | C++ Member of Indian Society for Technical EducationIndia

Rashmi jain

Assistant Professor at Institute of Advanced Study in Education.Bhopal, Madhya Pradesh, India

Sepideh rahmani

Project Manager at ArvanCloudIran

Matthew mullins

Attorney/Owner at Momentum Law, pllcMount Juliet, Tennessee, United States

Leyash pillay

Head of Marketing at Bundl | Corporate Venture DevelopmentAntwerp, Flemish Region, Belgium

Sumanta biswas

PTS at Manhattan AssociatesBengaluru, Karnataka, India

Kazi tanvir ahamed

OSS/BSS, IP,Transmissions & Cloud ExpertDhaka, Bangladesh

Amy pardo

Recrutadora de cargos estratégicos(português e espanhol); orientação de carreira e psicoterapia indi...São Paulo, Brasil

Fatih yıldızdal

SME Portfolio ManagerEskişehir, Türkiye

Audrey mccarthy, mph, cph

EchoNous Clinical Program ManagerSt Paul, Minnesota, United States

Manasi gupta

Product Leader | Zero-to-One Product Expert: IoT, AI, Automation || ISB, MNNIT || Personal Branding...Bengaluru, Karnataka, India

Zekeriya öztürk

Software Test EngineerAnkara, Türkiye

Sue faris70

Finance Assistant at Celcom Axiata BhdKuala Lumpur, Wilayah Persekutuan Kuala Lumpur, Malaysia

Michele nanna

R&D Chemist presso LUNA ABRASIVI SRLGreater La Spezia Metropolitan Area

Amy hegan

Technical Troubleshooting | incident managementSandy, England, United Kingdom

...

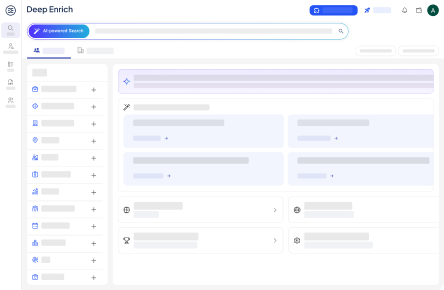

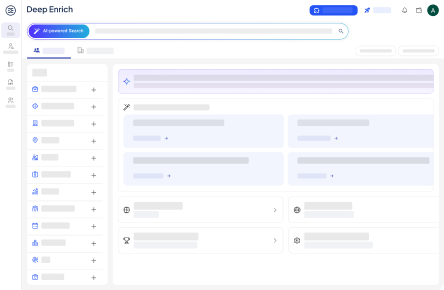

Deep Enrich

Deep Enrich